Enterprise Zones

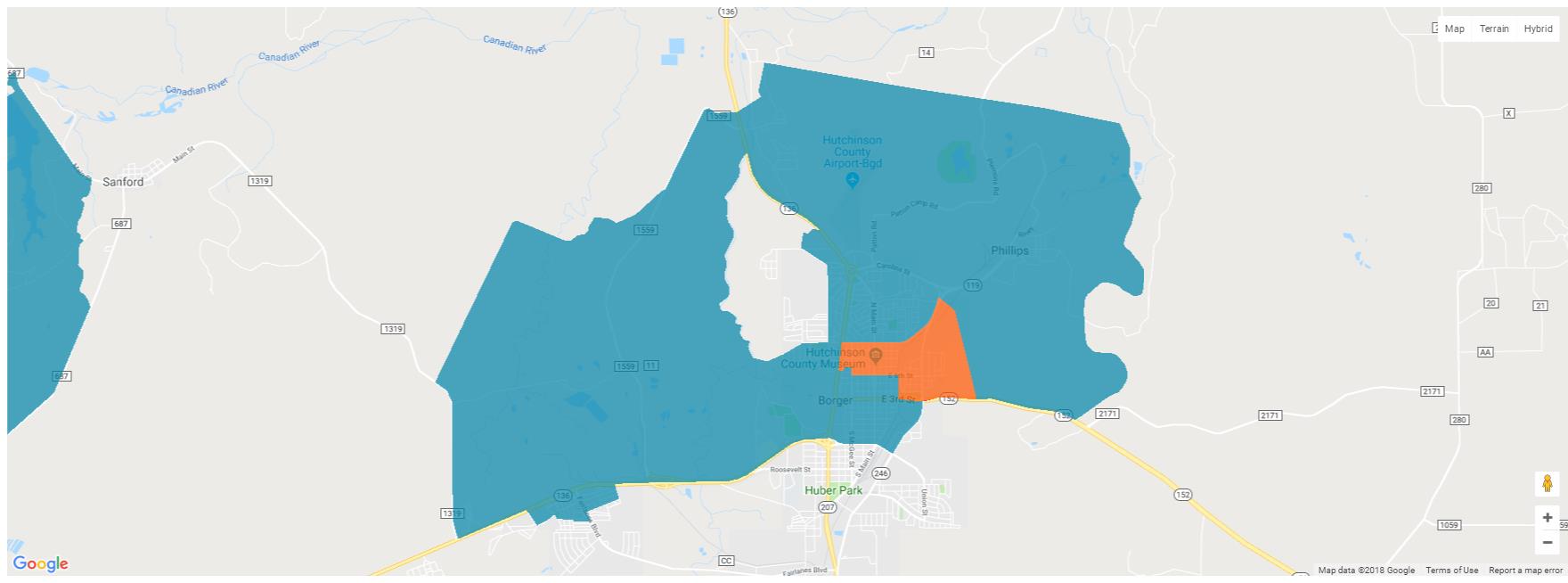

The Texas Enterprise Zone Program (EZP) is a State of Texas economic development tool available for communities to promote job creation and private investmet in economically distressed areas of the state. Borger has two Enterprise Zones that offer, to qualified projects, state sales and franchise tax rebates.

"This economic development tool allows local communities to partner with the state of Texas to encourage job creation and capital investment in economically distressed areas. Local communities can nominate a new or expanding business as an 'enterprise project.' Approved projects are eligible to apply for state sales and use tax refunds on qualified expenditures. The level and amount of refund depends on the capital investment and jobs created at the qualified business site." -Office of the Texas State Comptroller

This helpful guide from the Govenor's office explains the eligibility for the Texas EZP. If a project is eligible, a business can receive a state sales and use tax refund, with the amount awarded based on the company’s planned capital investment and job creation and/or retention at the qualified business site (see table below from the Govenor's Office of Texas Economic Development).

|

Level of Capital Investment |

Maximum Number of Jobs Allocated |

Maximum |

Maximum Refund Per Job Allocated |

|---|---|---|---|

|

$40,000 to $399,999 |

10 |

$25,000 |

$2,500 |

|

$400,000 to $999,999 |

25 |

$62,500 |

$2,500 |

|

$1,000,000 to $4,999,999 |

125 |

$312,500 |

$2,500 |

|

$5,000,000 to $149,999,999 |

500 |

$1,250,000 |

$2,500 |

|

Double Jumbo Project |

500* |

$2,500,000 |

$5,000 |

|

Triple Jumbo Project |

500* |

$3,750,000 |

$7,500 |

*Double and Triple Jump Projects may not count retained jobs for benefit. A Triple Jumbo Project must create at least 500 jobs.